The Ultimate Options Course

In the next 30 days, you'll learn to read options the way institutions do — so you stop bleeding money on random trades and finally know why your decisions make sense.

Why I Left the Banks & Started Teaching

“You've probably seen a hundred option trading courses online. Most promise overnight success. Mine doesn't. I just want to teach you within 30 days what actually works — because I've seen what doesn't.”

After 20 years inside top financial institutions — having managed billions in option positions — I had the money, the status, the respect. As the former head of European options trading desks at Citigroup and Bank of America, I was running huge risk, trading strategies which I now teach to retail traders, and mentoring junior traders who went on to run their own desks.

But something was missing. The part I loved most wasn't making millions — it was teaching others how to make sense of it all. After two decades in the trenches, I left it all behind and launched Options Insight — a place to teach real institutional strategies in a way that makes sense for normal people.

This course is the result — 72 lessons distilled from everything I've learned running institutional books, mentoring bank traders, and coaching hundreds of retail students since 2018. I keep refining and adding to it as markets evolve, because the goal is for this to be the definitive resource on how to trade options properly.

What's Inside the Course

This isn't theory for the sake of theory. It's a complete reset in how you look at options — so you can see opportunities early, control your risk, and place trades that make sense instead of hoping they work.

8 modules + bonus case studies, each stacking on the last. Built for every type of trader:

Option Basics

A beginner-friendly breakdown of basic option payoffs, covering key definitions, pricing inputs, value components, and how to read an options chain.

Option Fundamentals

A comprehensive guide to the option Greeks — Delta, Gamma, Vega, Theta, Vanna and Charm. In-depth explanation of term structure and skew.

Option Strategies

Key multi-leg option strategies focused on volatility, including spreads, ratios, risk reversals, collars, butterflies, condors, and calendar spreads.

Options Intuition

Build intuition for options pricing through model-free 0DTE analysis, put/call parity, butterfly valuation, and assessing when options look mispriced.

VIX Mastery

Master the VIX by learning its mechanics, how to trade VIX futures and options, monitor VIX beta and vol of vol, and apply proven trading strategies.

Portfolio Hedging

Practical portfolio hedging techniques using protective puts, put spreads and collars. Identify optimal market conditions for each strategy.

Selecting & Adjusting Trades

Master trade selection and management of iron condors, earnings calendars, directional trades, and collars — using rolling techniques to optimize profits.

Portfolio Management

Portfolio management techniques focused on position sizing, diversification, capital efficiency, and aligning trades with your risk and return objectives.

Case StudiesBonus

Real-world case studies across delta, theta, vega and hedging — showcasing strategy selection, trade management, and real P&L breakdowns.

Unlock These Bonuses Worth $1,697 Free

Join today and get all three bonuses included with your purchase.

Free Access to the Alpha Pod for 3 Months

A whole new level of access designed to give you more bang for your buck. See all of Imran's live trades via the Discord chatroom — not just what he trades, but why, and how to think through every move yourself. You'll get an inside look at decision-making across delta, theta, vega, single stocks, crypto, and hedging.

Applicable to both current and non-Alpha Pod subscribers. Existing subscribers get a 3-month extension free.

Quarterly Fee: $399

FREE

Real Case Studies

Unlock real-world trade breakdowns — see how ideas were spotted, structured, and managed. You get an instant extra module with trade example videos across delta, theta, vega, and hedging — highlighting real trades that were executed, how they were managed, the P&L performance, and key takeaways.

Value: $299

FREE

Lifetime Access to the Video Lessons Vault

- Exclusive Content: New lessons based on real-world changes in market dynamics, volatility, trading narratives, and portfolio hedging techniques.

- New Strategies: Discover new tactical approaches revealed as market conditions evolve — so your trading edge stays razor sharp.

- Fresh Insights: Deeper breakdowns of institutional trade thinking, vol structures, and narrative shifts — so you're always one step ahead.

- Walk-Throughs: Learn about new platforms, tools, and services integrated into Imran's own trading playbook — including how to use them.

Value: $999

FREE

Included value: $4,697

Your investment: $999

Trade Options With Confidence and Clarity

Lifetime access. One-time payment. All bonuses included.

One-time investment

$999

Lifetime access to all 72 lessons + all 3 bonuses

Buy now, pay later available (Affirm/Klarna)

Get Instant Access$999

First 72 hours — with all bonuses

$1,499

After — without Alpha Pod access

Skills in Action

See the course concepts applied to real trades.

$VIX Long Call Fly Ahead of '24 US Election

This trade makes volatility work in our favor amidst elevated risk premium.

Behind the Scenes: Trade Ideas Process

Explore Imran's daily options trading process from start to finish.

VIX, Nasdaq, Stocks: Trades on the Radar

A covered call ladder on VIX, a Nasdaq put fly, plus ETF and stock ideas.

Judge Me by My Students

Real traders. Real results. Real reviews.

“Imran is the best options teacher I have ever met. A trustworthy and incredible teacher! He teaches options in such an intuitive way that I can handle the Greeks much easier and faster. I spent lots of time reading books and doing academics, but taking Imran's class turned out to be the best way to master options trading. He teaches complicated stuff in such a simple and condensed manner. Whether you are a student or retail trader, it's a great learning opportunity.”

Sonny S.

Course Graduate

“Imran's technical knowledge and foundations on Equities, Derivatives, and Options are second to none. When I started on my graduate programme at Credit Suisse, I used to regularly have one-to-one sessions with him and he was clearly able to marry up the academic learning with real-world trading and market insights. Would highly recommend him to anyone who wants to learn about this space.”

Kanishk Swarup

Credit Suisse Graduate Programme

“Imran is a great teacher. He is able to explain complex concepts in a simple manner, and is passionate and very patient — which makes learning with him very enjoyable. He doesn't just teach specific trading techniques, but rather how to think about options and trading. He has been a big influence to me, and I credit much of my success to his mentorship during the early stages of my career. I still use some concepts that he taught me in my day to day trading now.”

Anh Nguyen

Professional Trader

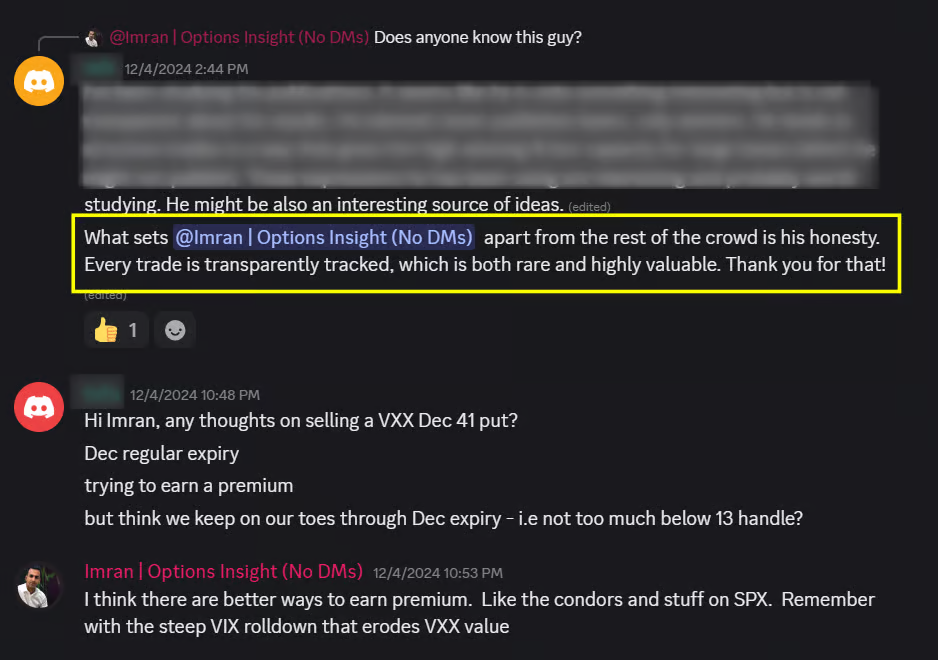

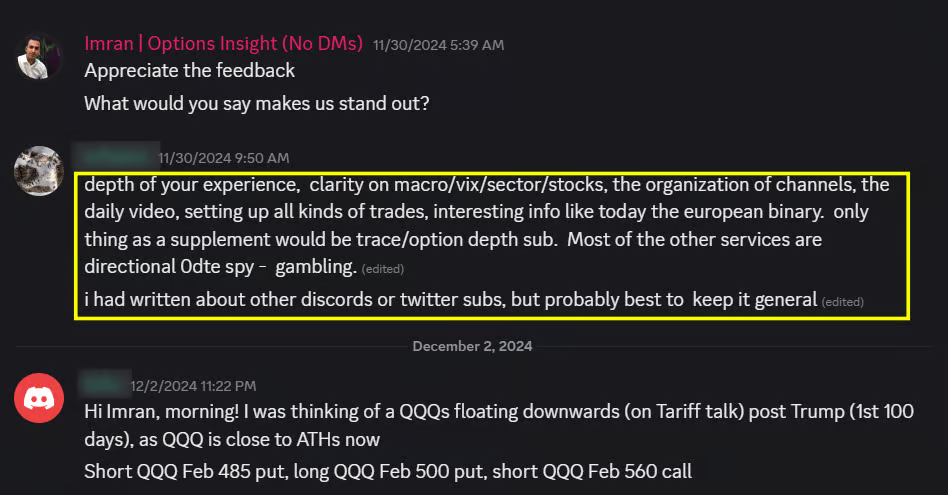

What They Say in the Discord Chatroom

Real conversations from the Alpha Pod Discord

The Transformation You Can Expect

Before the Course

- Familiar with "call" and "put" but can't explain how time decay, volatility, or moneyness affect option value

- Glancing at options chains and feeling overwhelmed — bids, asks, Greeks, open interest are noise, not insight

- Guessing at pricing inputs and second-guessing every entry and exit

- Treating volatility as a buzzword, not a measurable edge — watching profitable traders capitalize while you miss opportunities

- Piecing together random strategies with no clear framework — inconsistent results and mounting frustration

- No repeatable system for hedging, managing risk, or adjusting trades as markets move

After the Course

- A rock-solid foundation in every core concept — intrinsic vs time value, Greeks, skew, term structure

- You dissect options chains like a pro — understanding how to identify value, read flows, and structure multi-leg trades

- You use delta, gamma, vega and theta with clarity, assessing the true risk and reward in every trade

- You use volatility as a weapon, not a mystery — you measure, monitor, and exploit both implied and realized vol

- A complete playbook of proven strategies (spreads, butterflies, calendars, VIX plays) tailored to any market

- Confidence to hedge, adjust, and scale positions dynamically — turning losers into winners before expiry

Service Guarantee

What You Get: Imran keeps working with you free of charge until you achieve recurring extra monthly income and you no longer get confused entering trades. This essentially guarantees that you will achieve the goals you set.

How It Works: Provided you have gathered a sample of at least 30 option trades or 30 days of live trading (share your account statement), and results are not on your side, this is what happens:

- Email support@options-insight.com requesting the “service guarantee.”

- Imran will work with you and others in a similar position on a dedicated private Discord channel.

- This assistance is valued at 4 digits. You pay $0.

- Daily questions answered. You show commitment, Imran keeps working with you.

Only 2 Scenarios: Best case, you get the results you desire by putting in the work (as Ivan, Anh, and many others have). Worst case, you tell Imran the course is not enough — he takes you under his wing and you turn the corner together.

If I can't help you make money, then I don't deserve yours.

Frequently Asked Questions

Start Learning Today

One investment. Lifetime access. Institutional-grade education.

One-time investment

$999

Lifetime access to all 72 lessons + all 3 bonuses

Buy now, pay later available (Affirm/Klarna)

Get Instant Access